All of the following policies and procedures apply when The University of Iowa pays a consultant (UI employee or non-UI employee).

What is a Professional Services Agreement (PSA)?

Professional Service Agreements are contracts for unique, technical and/or infrequent functions performed by an independent contractor qualified by education, experience and/or technical ability to provide services. In most cases these services are of a specific project nature, and are not a continuing, on-going responsibility of the institution, except in the broadest sense. The services rendered are predominately intellectual in character even though the contractor may not be required to be licensed. Professional service agreements may be with partnerships, firms or corporations as well as individuals.

When is a PSA required?

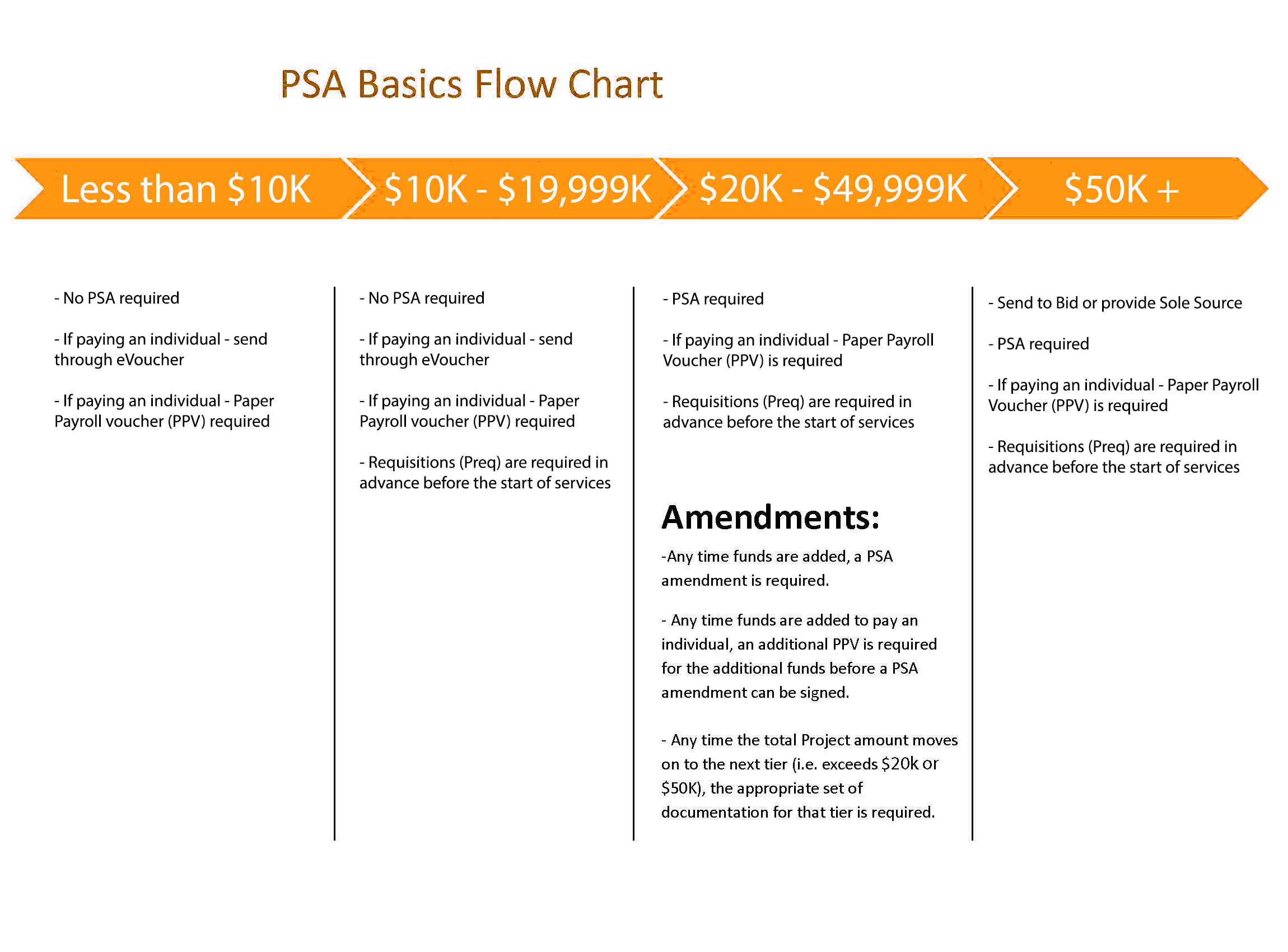

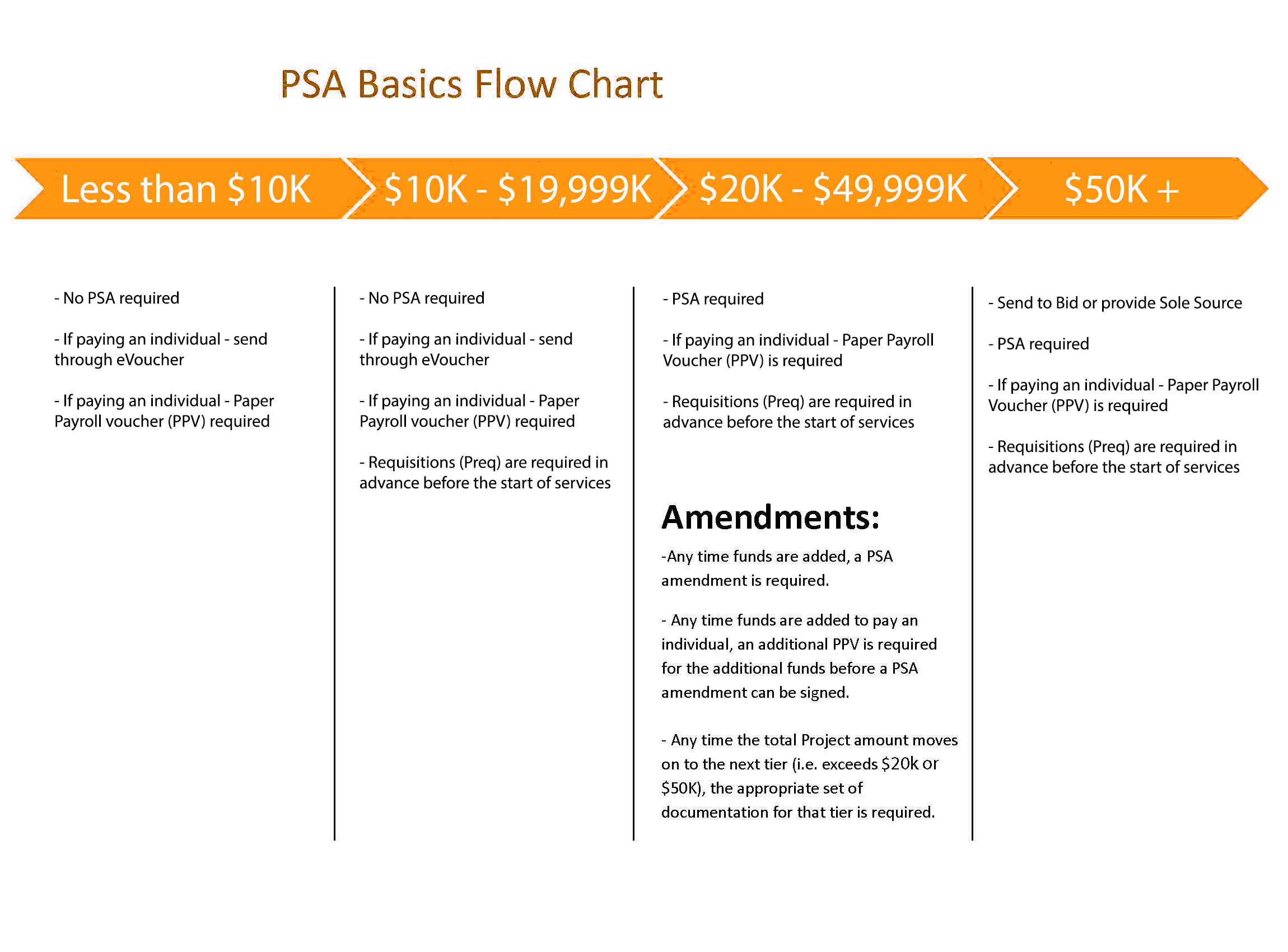

A written Professional Services Agreement (PSA) must be used for consultants who are not University employees and who receive payments from the University meeting or exceeding a total cost of $20,000. If the expected fees for services meet or exceed $50,000, the University is required to issue a bid. If no other vendors can provide these services, a Sole Source Justification Form must be submitted to Purchasing for approval by the Regents Chief Operations Officer(COO).

Departments can download the Professional Services Agreement form. Once completed, a department can either send it to the appropriate purchasing agent for review or send it directly to the vendor for signatures. If vendor contact information is provided, the Purchasing department will send the department’s completed PSA form to the vendor.

Exceptions:

Exceptions:

A PSA is not required:

Rules regarding UI Employees

Unless otherwise justified and documented, payments to University of Iowa (hereafter "University") employees will be treated as extra compensation payments and processed accordingly. For income tax purposes, the status of such consultants will be that of University employees, not of independent contractors. The established University policy is to treat all payments to University employees for services as part of their total compensation and to withhold on them accordingly. University employees are subject to University of Iowa and Board of Regents policies and regulations, which set forth terms and rights regarding conflict of interest, inventions and intellectual property. Thus, no written Professional Service Agreement will be required when University employees perform services on University grants or contracts. To initiate this determination, contact Payroll, Tricia Sutton or Stacey Halverson .

A written Professional Services Agreement must be used for consultants who are not University employees and who receive payments from the University in excess of $20,000 per project. For income tax purposes, the University of Iowa Payroll Department will determine the status of consultants who are not University employees. Whether the status of such consultants is considered that of employees or of independent contractors will be determined based on the relevant facts of each arrangement by answering the questions on the U.S. Internal Revenue Service (IRS) checklist to see whether a consultant is an independent contractor or subject to federal tax withholding. The determination should occur prior to submission on the proposal, if possible. To initiate this determination, contact Tricia Sutton or Stacey Halverson .

A written Professional Services Agreement is not required for consultants who are recently terminated or retired University employees. For income tax purposes, such consultants will be considered as University employees, not independent contractors, unless otherwise justified and documented. The University Payroll Department will determine whether there is sufficient justification to consider such consultants as independent contractors for income tax purposes. The determination should occur prior to submission on the proposal, if at all possible. To initiate this determination, contact Tricia Sutton or Stacey Halverson . If the Payroll Department deems the consultant to be an independent contractor, then a written Professional Services Agreement is required.

For payments less than $10,000, the consultant must submit an invoice to the department. Payments may also be made with the Procurement Card, if accepted by vendor.

No PSA required. If paying an individual send through eVoucher. If paying an individual a Paper Payroll voucher (PPV) required. Requisitions (Preq) are required in advance before the start of services.

Complete a paper Payroll Voucher form and W-8Ben form and route to payroll.

Payments applied to purchase orders for professional services should be submitted as an invoice on the Firm’s letterhead. Invoices for payment must be submitted to:

The University of Iowa | Accounts Payable | 202 Plaza Centre One | Iowa City, IA 52242-2500 or acntpay@uiowa.edu

All invoices should include a reference to the purchase order number assigned to the agreement and the compensation rate and number of hours or days of service if payment is to be made other than fixed fee.

Purchasing and the department must review this project to establish a bid for services. If no other vendors are able to provide the required services, a Sole Source Justification form must be submitted with the purchase requisition or completed on purchase requisition form. Once received by Purchasing it will be submitted to the COO for approval.