Current Agricultural Use Value, or CAUV, is a program where farmland is taxed at a rate that reflects its value for agricultural purposes instead of its value as development property. It was enacted by Ohio voters in 1973 as a means to preserve farmland. In 2014, Ohio Farm Bureau began working to reform how CAUV is calculated, resulting in major reforms enacted in June 2017. Increases are expected in 41 counties in 2024, and those on the 2024 reappraisal will see the same situation on their January 2025 tax bills. . See our FAQ for more details.

Ohio Farm Bureau is continuing to work multiple channels to address concerns around CAUV – particularly the issue of values spiking significantly.

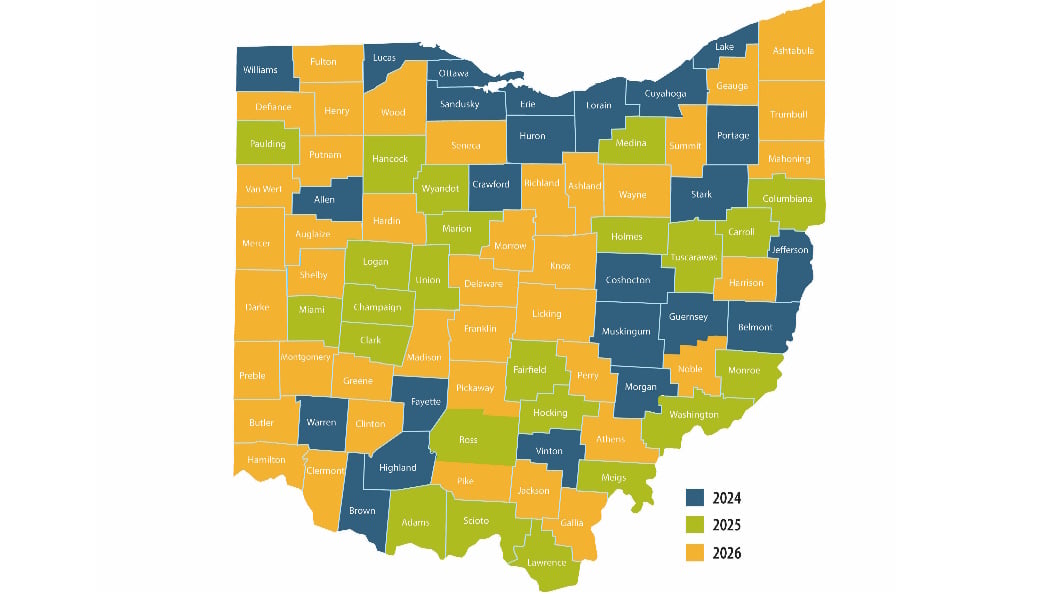

An upward trend in CAUV values and significant increases in soil values for 2024 apply only to counties that are being reappraised or updated in 2024.

The July/August 2024 Our Ohio magazine takes a deeper dive into a program that impacts nearly all members across the state, CAUV.

As Ohio Farm Bureau Policy Counsel Leah Curtis notes in this Legal with Leah, these changes should result in significant tax savings for many Ohio woodland owners.

CAUV 202 took a deeper dive into how tax bills are formulated and what exactly goes into the Current Agricultural Use Value numbers.

After years of advocacy from Ohio Farm Bureau and its partners, the Ohio Department of Taxation announced today that it will address inaccurate woodland calculations in the Current Agricultural Use Value program.

Taking a look at the history of CAUV can help with understanding its structure, fluidity and the eternal vigilance needed by Ohio Farm Bureau and our members for its sustainability.

Kelly Tennant’s story starts as many others in agriculture do, but her current day job impacts Ohio ag more than most.

Learn more about eligibility and how to include conservation practices on CAUV enrollment forms.

Bob and Polly Givens are on a mission to inform small landowners-homesteaders of the advantages of CAUV.

Got questions or feedback?

We'd love to hear from you.

Ohio Farm Bureau Federation is a member of American Farm Bureau Federation®, a national organization of farmers and ranchers including Farm Bureau® organizations in 49 other states and Puerto Rico, and is responsible for Farm Bureau membership and programs within the State of Ohio. Ohio Farm Bureau Federation programs and services are available only to Farm Bureau members within Ohio. The political views expressed in these pages represent Ohio Farm Bureau Federation's positions on various issues as they relate to Ohio. The positions of the national Farm Bureau organization collectively are expressed through American Farm Bureau Federation. Any opinions, statements or views expressed through comments or by outside contributors are the express views of those individuals and do not necessarily represent the views of the Ohio Farm Bureau Federation.

Got questions or feedback?

We'd love to hear from you.

Ohio Farm Bureau Federation is a member of American Farm Bureau Federation®, a national organization of farmers and ranchers including Farm Bureau® organizations in 49 other states and Puerto Rico, and is responsible for Farm Bureau membership and programs within the State of Ohio. Ohio Farm Bureau Federation programs and services are available only to Farm Bureau members within Ohio. The political views expressed in these pages represent Ohio Farm Bureau Federation's positions on various issues as they relate to Ohio. The positions of the national Farm Bureau organization collectively are expressed through American Farm Bureau Federation. Any opinions, statements or views expressed through comments or by outside contributors are the express views of those individuals and do not necessarily represent the views of the Ohio Farm Bureau Federation.